market research studiesSinger's 2008 Bank Brokerage Compensation Study This 63-page study, supported by the Bank Insurance & Securities Association (BISA), has been conducted biannually since 1993. It addresses compensation issues relating to managers and salespeople in retail bank investment programs, focusing

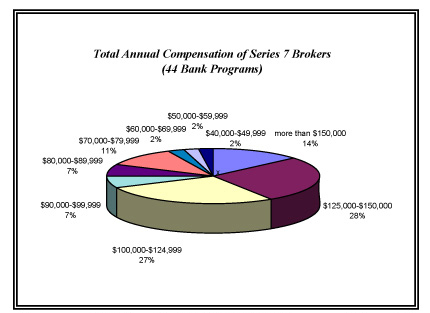

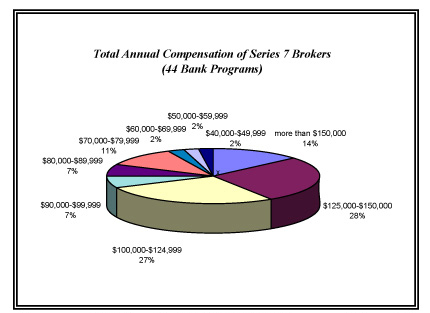

particularly on annuities, mutual funds, life insurance, and fee-based products. Among the questions addressed: - What are the

compensation levels of program managers? Do they vary significantly based on the size of the institution, the breadth of managerís responsibilities, or the amount of program revenues generated?

- From where are dedicated salespeople recruited? Wirehouses? Other bank brokerage programs? How much of their compensation is in the form

of commission? H

ow much salary? What is the typical sales specialist earning each year? The top performers? ow much salary? What is the typical sales specialist earning each year? The top performers? - How many sales managers do institutions typically employ? What are they paid? What percentage of their compensation is commission?

- How much incentive compensation is paid to platform personnel who sell investment products?

- What order of profits does the typical dedicated rep earn for his or her bank?

Forty-seven institutions participated in the 2008 study: - Eight were "very large" institutions (with

more than $15 billion in retail deposits).

- Fourteen were "large" institutions (with $5 billion to $15 billion in retail deposits).

- Sixteen were "medium" size institutions (with $1.5 billion to $4.99 billion in retail deposits).

- Nine were "small" institutions (with less than $1.5 billion in retail deposits).

See contents page

See sample pages BISA members enjoy steep discounts when ordering the study, which was available for shipment in August 2008. 1. Regular Study price: $695

2. BISA Member Price: $495

3. Bank Participantís Price (Non BISA): $395

4. Bank Participant (BISA member): $295

|

ow much salary? What is the typical sales specialist earning each year? The top performers?

ow much salary? What is the typical sales specialist earning each year? The top performers?